Archer Aviation is revolutionizing air travel with its innovative electric vertical takeoff and landing (eVTOL) aircraft. This exploration delves into Archer’s business model, technological advancements, market position, financial performance, and commitment to sustainability, providing a comprehensive overview of this pioneering company and its impact on the future of urban air mobility.

From its ambitious manufacturing and distribution strategies to its cutting-edge aircraft design and safety features, Archer Aviation is strategically positioned to capitalize on the burgeoning eVTOL market. The company’s financial projections and investor relations strategies are also key components of this analysis, alongside a critical examination of its competitive landscape and potential regulatory challenges.

Archer Aviation’s Business Model

Archer Aviation aims to establish itself as a leading player in the burgeoning urban air mobility (UAM) market. Its business model hinges on the successful design, manufacturing, and operation of electric vertical takeoff and landing (eVTOL) aircraft, coupled with a strategic approach to revenue generation and market penetration.

Archer Aviation, known for its innovative electric vertical takeoff and landing (eVTOL) aircraft, is constantly exploring new technologies. Their testing often involves monitoring various environmental factors, and a key resource for this is real-time visual data, such as that provided by the port dover camera , which offers a valuable perspective on weather conditions. This data helps Archer Aviation ensure safe and efficient flight operations for their groundbreaking aircraft.

Archer Aviation’s Revenue Streams and Projected Profitability

Archer’s primary revenue stream will be derived from the sale of its eVTOL aircraft to air taxi operators and other commercial entities. Additional revenue is anticipated from maintenance, repair, and overhaul (MRO) services, as well as potential revenue sharing agreements with operational partners. Projecting profitability is challenging in this nascent market, but Archer’s financial projections suggest profitability within a specific timeframe, contingent upon factors like production scale, operational efficiency, and market demand.

This will likely follow a typical technology company growth pattern, with initial losses followed by increasing revenue and eventual profitability.

Archer Aviation’s Aircraft Manufacturing and Distribution Strategy

Archer plans to leverage partnerships and strategic alliances for aircraft manufacturing and distribution. This approach aims to mitigate the significant capital investment required for establishing large-scale manufacturing facilities independently. The company’s distribution strategy likely involves a network of authorized dealers and service centers to ensure global reach and customer support. This phased approach allows for scalability and reduces upfront risk.

Comparison of Archer Aviation’s Business Model to Competitors

Archer’s business model differs from competitors in several key aspects. While some competitors focus solely on aircraft development, Archer aims to integrate vertically, encompassing aircraft manufacturing, operational partnerships, and potentially even direct air taxi services. This vertical integration provides greater control over the value chain but also entails higher risk and greater capital requirements. A detailed competitive analysis comparing Archer’s approach to companies like Joby Aviation, Lilium, and Vertical Aerospace would reveal distinct strategies regarding manufacturing, distribution, and service models.

SWOT Analysis of Archer Aviation’s Current Market Position

Archer’s SWOT analysis reveals both strengths and weaknesses. Strengths include its innovative aircraft design, strategic partnerships, and strong investor backing. Weaknesses include the relatively early stage of development, dependence on external partners, and the inherent risks associated with a new technology market. Opportunities lie in the rapidly growing UAM market and potential for expansion into diverse applications.

Threats include intense competition, regulatory hurdles, and the potential for technological disruptions.

Hypothetical Marketing Campaign Targeting Potential Investors

A successful investor marketing campaign would emphasize Archer’s technological leadership, experienced management team, and clear path to profitability. The campaign could leverage compelling visuals showcasing the aircraft’s design and performance capabilities. Key messaging should focus on the significant market opportunity presented by the UAM sector and Archer’s strategic positioning to capture a substantial market share. This would likely involve targeted advertising in financial publications, participation in industry conferences, and the development of comprehensive investor presentations.

Archer Aviation’s Technology and Innovation

Archer’s success hinges on its technological advancements and innovative approach to eVTOL aircraft design. The company’s commitment to safety and performance is paramount to its overall strategy.

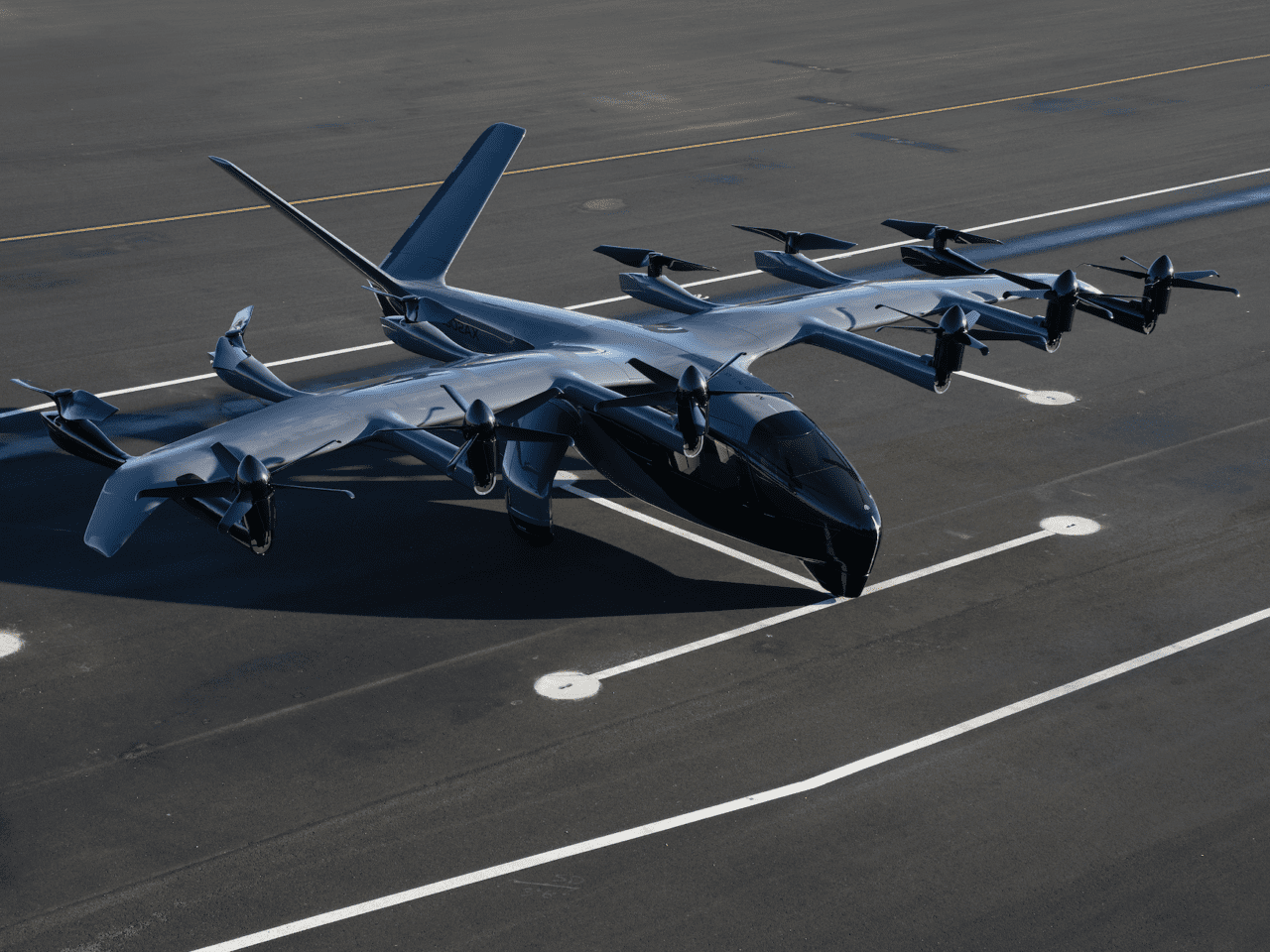

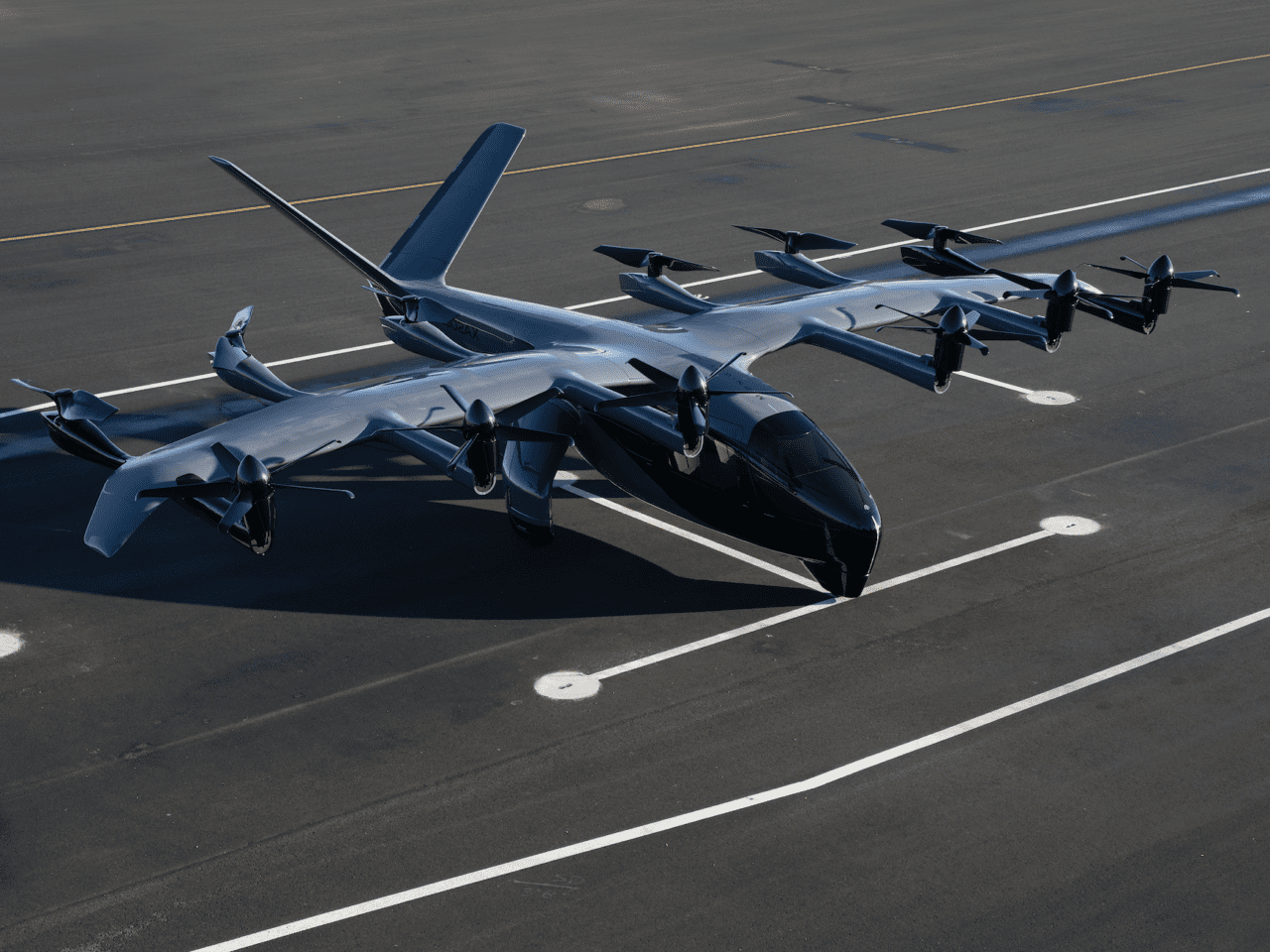

Technological Advancements in Archer’s Aircraft Design

Archer’s aircraft incorporates several key technological advancements, including its unique distributed electric propulsion system, advanced flight control algorithms, and lightweight composite materials. These technologies contribute to the aircraft’s efficiency, safety, and performance characteristics. Specific details on the proprietary technologies used remain partially confidential for competitive reasons but public information emphasizes advancements in battery technology and motor design for optimal efficiency and range.

Safety Features and Testing Procedures

Archer prioritizes safety, incorporating redundant systems and advanced sensors to ensure reliable operation. Rigorous testing procedures, including extensive simulations and flight tests, are conducted to validate the aircraft’s safety and performance. The company is working closely with regulatory bodies to meet all necessary safety certifications. These tests include both simulated and real-world flight conditions to ensure safety under various scenarios.

Comparison of Archer’s Aircraft Performance to Competitors

Archer’s aircraft boasts competitive performance specifications, including speed, range, and payload capacity. However, a direct comparison with competitors requires a comprehensive analysis of various factors, including battery technology, propulsion system design, and overall efficiency. While specific performance data is often proprietary, general comparisons suggest Archer is aiming for a competitive position within the market, focusing on a balance between speed, range, and payload capacity.

Potential Technological Challenges

Archer faces potential technological challenges, including advancements in battery technology to increase range and reduce charging time, the development of robust and reliable propulsion systems, and the integration of advanced flight control systems. Further challenges include managing the complexities of air traffic management in urban environments and ensuring the long-term durability and maintainability of the aircraft.

Timeline of Archer Aviation’s Technological Development

Archer’s technological development can be illustrated through a timeline highlighting key milestones, such as the initial design concept, prototype development, successful test flights, and achievement of key regulatory approvals. This timeline demonstrates the company’s progress and provides a framework for future development plans. Public information suggests a timeline that progresses from initial concept and design to prototype testing and subsequent iterative improvements based on test results and regulatory feedback.

Archer Aviation’s Market Position and Competition

The eVTOL market is rapidly evolving, with several companies vying for market leadership. Archer’s position within this competitive landscape is defined by its technological advancements, business strategy, and market penetration efforts.

Current Market Landscape and Archer’s Place Within It

The eVTOL market is characterized by significant growth potential, driven by increasing demand for urban air mobility solutions. Archer is positioned to capture a share of this market through its innovative aircraft design, strategic partnerships, and focus on commercial applications. The market is still in its early stages, with significant opportunities for growth and consolidation in the coming years.

Key Competitors and Their Strengths and Weaknesses

Archer faces competition from several established and emerging companies, each with its own strengths and weaknesses. These competitors differ in their technological approaches, business models, and market strategies. A detailed comparative analysis would highlight the specific advantages and disadvantages of each competitor, allowing for a nuanced understanding of Archer’s competitive landscape. This analysis would need to consider factors such as technological maturity, funding, and regulatory compliance.

Comparative Analysis of Archer’s Aircraft Pricing and Specifications

A direct comparison of Archer’s aircraft pricing and specifications against its competitors is difficult due to the proprietary nature of some data. However, a general comparison can be made based on publicly available information.

| Company | Aircraft Model | Price Range (USD) | Top Speed (mph) |

|---|---|---|---|

| Archer Aviation | Midnight | Estimate: $3-5 million (projected) | ~150 (projected) |

| Joby Aviation | S4 | Not publicly disclosed | ~200 (projected) |

| Lilium | Jet | Not publicly disclosed | ~175 (projected) |

| Vertical Aerospace | VAX-4 | Not publicly disclosed | ~150 (projected) |

Note: Price ranges and top speeds are estimates based on available information and may not be entirely accurate.

Potential Market Opportunities and Challenges

Archer faces both significant opportunities and challenges in the coming years. Opportunities include expansion into new markets, development of new applications for its aircraft, and potential for strategic acquisitions. Challenges include securing necessary regulatory approvals, managing supply chain risks, and intense competition from established and emerging players.

Potential Regulatory Hurdles

Archer faces potential regulatory hurdles related to airworthiness certification, airspace management, and operational safety. Navigating these regulatory complexities will be crucial for the company’s success. This includes working closely with aviation authorities to ensure compliance with all relevant regulations and standards.

Archer Aviation’s Financial Performance and Outlook

Archer Aviation’s financial performance and outlook are crucial indicators of its long-term viability and success in the competitive eVTOL market. Analyzing its financial statements, funding sources, and projected growth is essential for assessing its investment potential.

Overview of Archer Aviation’s Financial Statements

Archer’s financial statements, including revenue, expenses, and profitability, are subject to change and are typically reported publicly on a quarterly and annual basis. Analyzing these statements reveals trends in revenue growth, cost management, and overall financial health. A detailed analysis would require access to the company’s official financial reports and would consider key metrics such as operating margin, net income, and cash flow.

Funding Sources and Capital Structure

Archer’s funding sources include a combination of equity financing, debt financing, and potentially government grants or subsidies. Understanding its capital structure provides insight into its financial risk profile and its ability to fund future growth. This includes analyzing the mix of equity and debt, the terms of any debt financing, and the overall financial leverage of the company.

Projected Growth Trajectory and Financial Forecasts

Archer’s projected growth trajectory and financial forecasts are based on various assumptions, including market demand, production capacity, and operational efficiency. These forecasts are typically presented in investor presentations and financial reports. Analyzing these forecasts requires a critical assessment of the underlying assumptions and a comparison to industry benchmarks.

Investor Relations and Communication Strategies

Archer’s investor relations and communication strategies are vital for maintaining transparency and building trust with investors. Effective communication is essential for attracting investment, managing investor expectations, and maintaining a positive market perception. This includes regular communication through press releases, investor presentations, and engagement with financial analysts.

Financial Model Projecting Market Capitalization in Five Years

Projecting Archer’s market capitalization in five years requires a sophisticated financial model incorporating various assumptions, including revenue growth, profit margins, and market multiples. This model would need to account for potential risks and uncertainties, such as competition, regulatory changes, and technological advancements. A realistic projection would be based on a range of scenarios and would include sensitivity analysis to assess the impact of different assumptions.

Archer Aviation is making significant strides in the electric vertical takeoff and landing (eVTOL) aircraft sector. Their innovative designs and commitment to sustainable aviation are noteworthy. For more detailed information on their projects and progress, visit their profile on the Drone Fair website: archer aviation. Ultimately, Archer Aviation’s future contributions to the urban air mobility market are highly anticipated.

Archer Aviation’s Sustainability and Environmental Impact

Archer Aviation’s commitment to sustainability and its efforts to minimize the environmental impact of its operations are increasingly important considerations for investors and customers alike. The environmental benefits of eVTOL aircraft, compared to traditional helicopters, are a key selling point.

Commitment to Environmental Sustainability

Archer’s commitment to sustainability is reflected in its efforts to reduce the environmental footprint of its operations throughout the entire lifecycle of its aircraft, from design and manufacturing to operation and disposal. This commitment often includes initiatives related to energy efficiency, waste reduction, and the use of sustainable materials.

Environmental Benefits of eVTOL Aircraft Compared to Helicopters

eVTOL aircraft offer several environmental benefits compared to traditional helicopters, primarily due to their electric propulsion systems. These benefits include reduced noise pollution, lower greenhouse gas emissions, and decreased reliance on fossil fuels. A detailed comparison would quantify these benefits, highlighting the potential for significant environmental improvements.

Materials Used in Aircraft Construction and Their Sustainability

Archer utilizes various materials in the construction of its aircraft, with a focus on lightweight, high-strength composites and sustainable materials whenever possible. The selection of these materials is driven by a combination of performance requirements and environmental considerations. A detailed analysis would specify the materials used and assess their sustainability credentials.

Plans for Recycling and Disposal of Aircraft

Archer is developing plans for the responsible recycling and disposal of its aircraft at the end of their lifespan. This includes strategies for recovering valuable materials and minimizing waste sent to landfills. These plans are important for ensuring the long-term environmental sustainability of the company’s operations.

Lifecycle Environmental Impact Compared to a Traditional Helicopter, Archer aviation

A visual representation of the lifecycle environmental impact of Archer’s aircraft compared to a traditional helicopter could be a bar chart. The chart would compare the two aircraft across various stages of their lifecycle, including manufacturing, operation, and disposal. Each bar would represent a specific environmental impact category, such as greenhouse gas emissions, noise pollution, and waste generation.

The height of each bar would represent the magnitude of the impact for each aircraft type, allowing for a clear visual comparison of their relative environmental footprints. This would show the significant reduction in emissions and noise pollution from the eVTOL compared to the traditional helicopter across its entire lifecycle.

Archer Aviation’s journey to redefine urban air travel is marked by both significant progress and inherent challenges. The company’s success hinges on its ability to overcome technological hurdles, navigate a complex regulatory environment, and secure sustained financial backing. However, the potential rewards – a cleaner, faster, and more efficient mode of transportation – are substantial, making Archer Aviation a compelling case study in the future of aviation.

FAQ Resource: Archer Aviation

What is Archer Aviation’s primary market focus?

Archer Aviation’s primary market focus is urban air mobility, aiming to provide efficient and sustainable air transportation solutions within and between cities.

When is Archer Aviation expected to begin commercial operations?

Archer Aviation’s projected commercial operations timeline is subject to change, dependent on regulatory approvals and manufacturing milestones. Check their official website for the most up-to-date information.

What types of materials are used in Archer’s aircraft?

Archer’s aircraft construction incorporates a variety of lightweight, high-strength materials designed for optimal performance and sustainability. Specific details are often proprietary.

How does Archer Aviation plan to address the noise pollution associated with eVTOL aircraft?

Archer Aviation is actively working on noise reduction technologies to minimize the environmental impact of its aircraft, aiming to meet or exceed relevant noise regulations.